ECB Stress Monitor

How stressed is the ECB?

ECB Stress Scores

The Institute for Quantitative Finance calculates monthly ECB Stress Scores. The scores reflect the stress that the ECB is under due to inflation and interest rate developments in the euro area. Three stress scores are derived: an inflation-based score, an interest rate spread-based score, and an aggregate score that combines the two scores.

Each of the three scores is composed of two components: a level component reflecting the deviation of inflation and interest rate spreads from "ideal" levels, and a dispersion component reflecting the heterogeneity of inflation and interest rate spreads across euro area member countries.

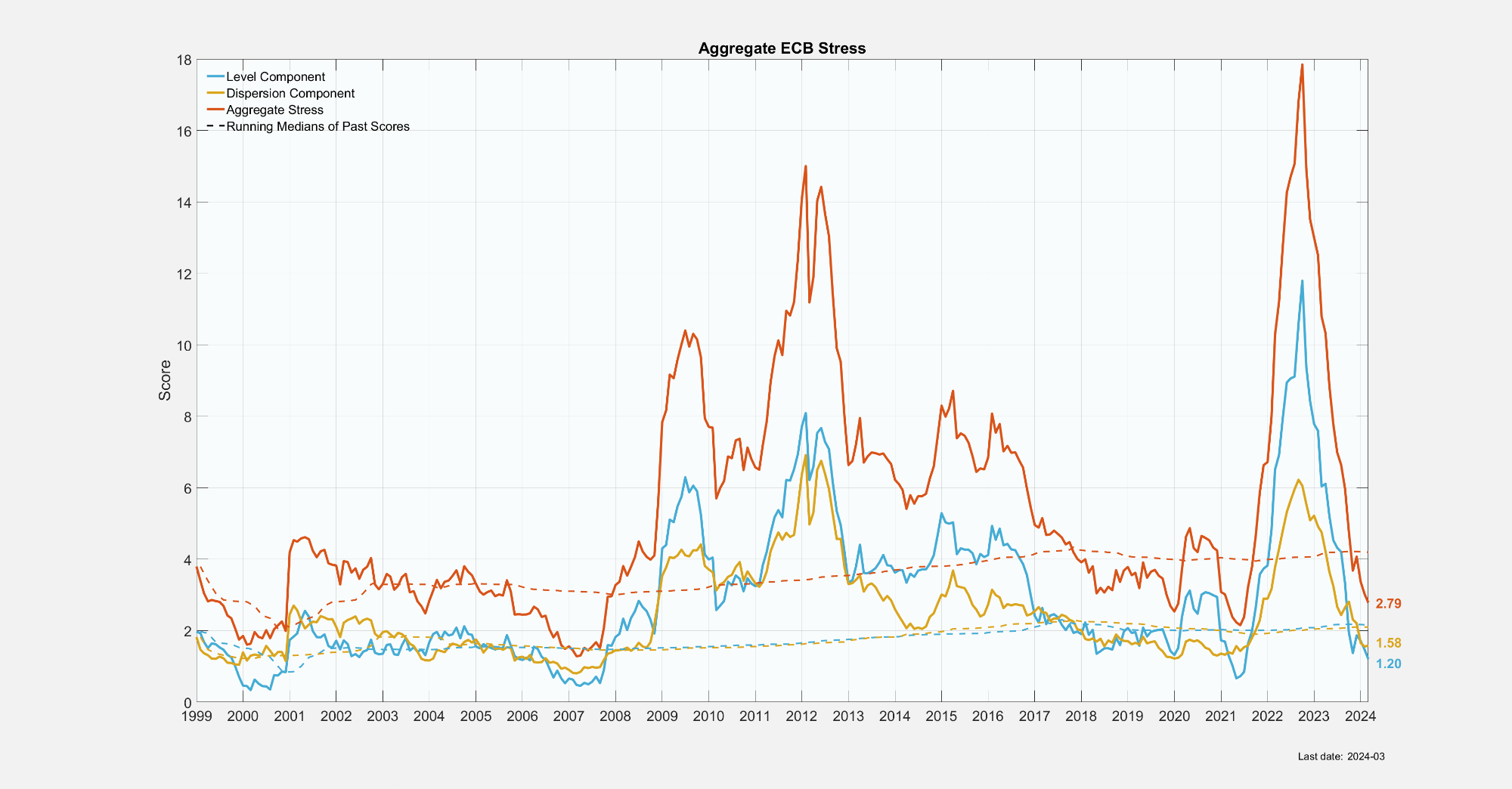

ECB Aggregate Stress

The ECB Aggregate Stress score combines the inflation stress and the interest rate stress scores shown below. As the individual stress scores, the aggregate stress score is composed of two components:

- The level component reflects the extent to which the overall euro area inflation and the interest rate spreads deviate from the 2% inflation target and a zero mean spread, respectively.

- The dispersion component expresses the heterogeneity across individual euro area member states with respect to inflation rates and interest rate spreads.

Data source: Eurostat, ECB, Bundesbank

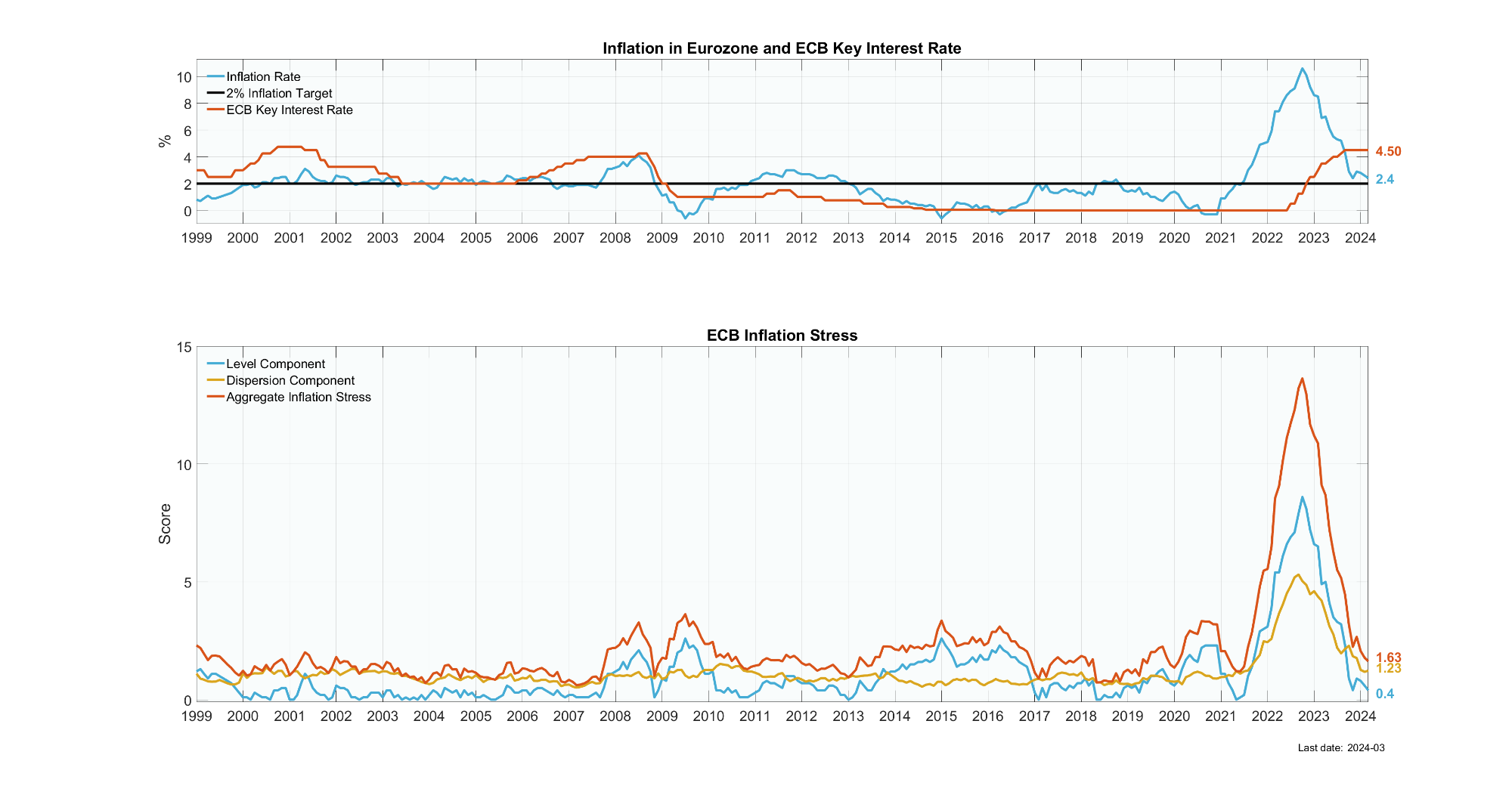

ECB Inflation Stress

The ECB Aggregate Inflation Stress score reflects the stress that the ECB is under due to the inflation rates at which eurozone countries are deviating from the ECB's 2% inflation target. The aggregate inflation stress score is a function of two components:

- The Inflation-Level Stress reflects the level with which the overall euro area inflation deviates from the 2% target. The greater the deviation from the target, the higher the level stress score.

- The Inflation-Dispersion Stress reflects the dispersion of the individual euro area member states' deviations from the 2% target. The more the individual countries' inflation rates differ from each other, the higher the dispersion stress score.

Also shown, the ECB key interest rate for main refinancing operations.

Data source: Eurostat, Bundesbank

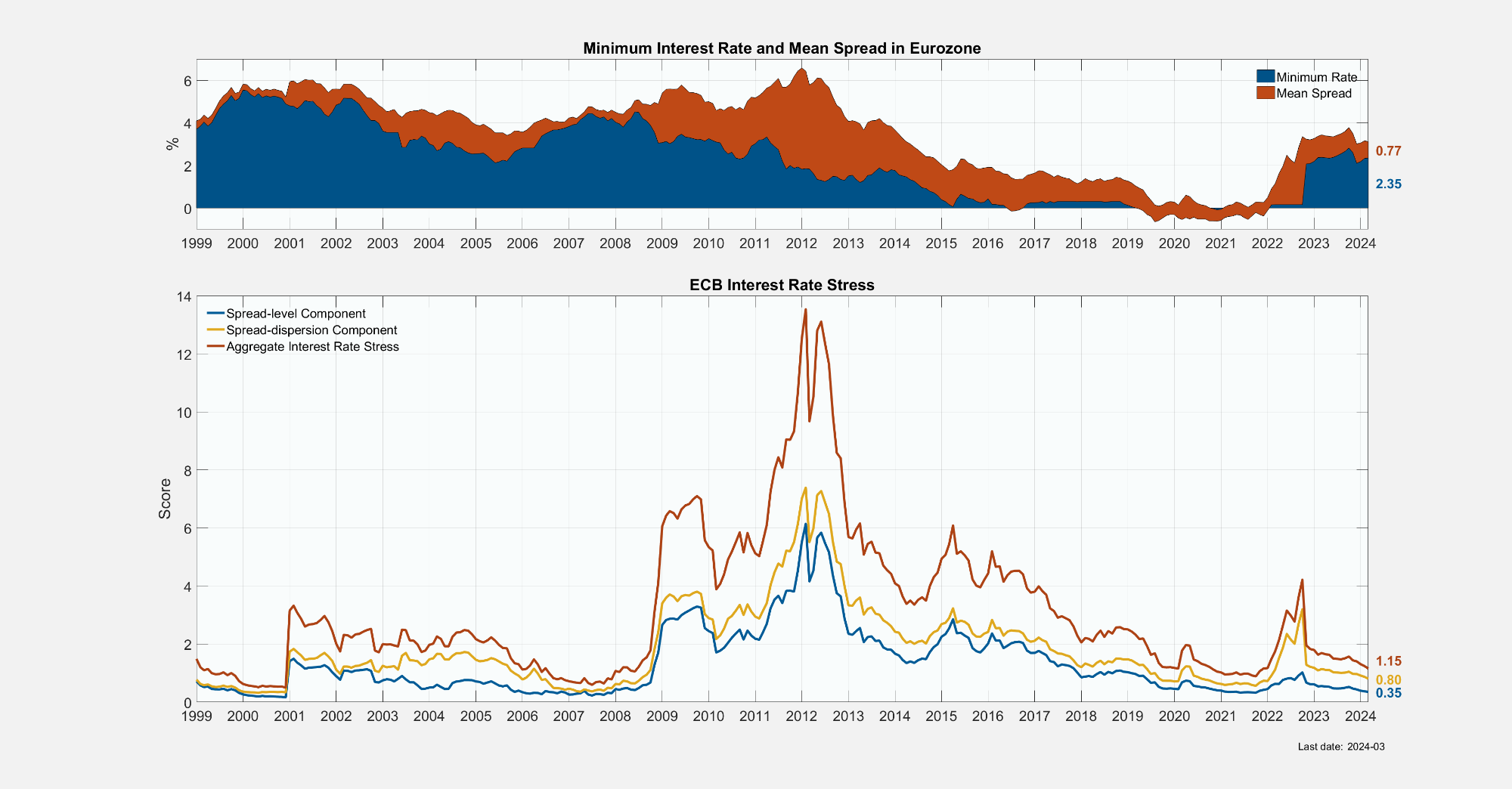

ECB Interest Rate Stress

The ECB Aggregate Interest Rate Stress score reflects the stress that the European Central Bank is under as a result of the movement in ten-year government bond rates in the eurozone countries. The aggregate interest rate stress score is made up of two components:

- The Spread-Level Stress reflects the level with which the mean of the interest rates of the member states deviates from the lowest rate among the member states. The greater the mean spread, the higher the level stress score.

- The Spread-Dispersion Stress reflects the dispersion of the spreads the individual eurozone members experience. The more the individual countries' interest rates differ from each other, the higher the dispersion stress score.

Data source: ECB

©2024 Institut für Quantitative Finanzanalyse IQFin GmbH. Alle Rechte vorbehalten. All rights reserved.

Wir benötigen Ihre Zustimmung zum Laden der Übersetzungen

Wir nutzen einen Drittanbieter-Service, um den Inhalt der Website zu übersetzen, der möglicherweise Daten über Ihre Aktivitäten sammelt. Bitte prüfen Sie die Details und akzeptieren Sie den Dienst, um die Übersetzungen zu sehen.